Essay

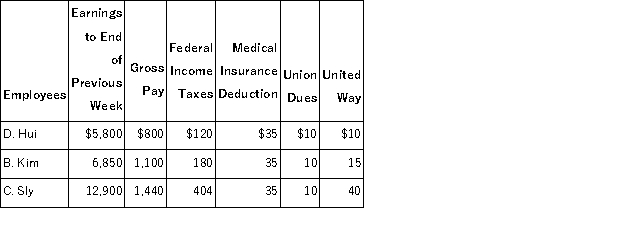

The payroll records of a company provided the following data for the current weekly pay period ended March 12.  Assume that the Social Security portion of the FICA taxes is 6.2% on the first $118,500 of earnings per calendar year and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $118,500 of earnings per calendar year and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for each employee.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Vacation benefits are a type of

Q38: Freedom Air collected $165,000 in February for

Q40: A company's payroll information for the month

Q43: The Federal Insurance Contributions Act (FICA)requires that

Q52: If the times interest earned ratio:<br>A)Increases,then risk

Q76: The annual Federal Unemployment Tax Return is:<br>A)

Q84: Employers can use a wage bracket withholding

Q111: A company's income before interest expense and

Q120: All of the following statements related to

Q137: On May 22,Jarrett Company borrows $7,500 from