Essay

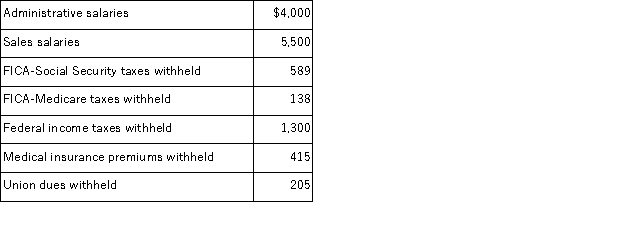

A company's payroll information for the month of May follows:  On May 31 the company issued Check No. 4625 payable to the Payroll Bank Account to pay for the May payroll. It issued payroll checks to the employees after depositing the check.

On May 31 the company issued Check No. 4625 payable to the Payroll Bank Account to pay for the May payroll. It issued payroll checks to the employees after depositing the check.

(1) Prepare the journal entry to record (accrue) the employer's payroll for May. (2) Prepare the journal entry to record payment of the May payroll. The federal and state unemployment tax rates are 0.6% and 5.4%, respectively, on the first $7,000 paid to each employee. The wages and salaries subject to these taxes were $6,000. (3) Prepare the journal entry to record the employer's payroll taxes.

Correct Answer:

Verified

*$6,000 *...

*$6,000 *...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Vacation benefits are a type of

Q12: Gross pay less all deductions is called

Q25: FUTA taxes are:<br>A)Social Security taxes.<br>B)Medicare taxes.<br>C)Employee income

Q37: The payroll records of a company provided

Q38: Freedom Air collected $165,000 in February for

Q43: A company sells sofas with a 6-month

Q52: If the times interest earned ratio:<br>A)Increases,then risk

Q76: The annual Federal Unemployment Tax Return is:<br>A)

Q120: All of the following statements related to

Q137: On May 22,Jarrett Company borrows $7,500 from