Essay

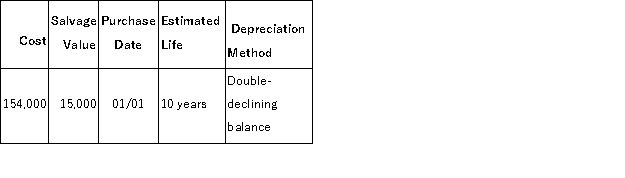

A company's property records revealed the following information about one of its plant assets:  Calculate the depreciation expense in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense in Year 1 and Year 2 for the year ended December 31.

Year 1 ______________________ Year 2 _______________________

Correct Answer:

Verified

Year 1: $154,000 × 20% = $30,8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: The relevant factors in computing depreciation do

Q27: On January 1,Year 1,Naples purchased a computer

Q38: A copyright gives its owner the exclusive

Q57: Holding a copyright:<br>A)Gives its owner the exclusive

Q59: The federal income tax rules for depreciating

Q85: When a company constructs a building, the

Q106: Depletion is:<br>A)The process of allocating the cost

Q107: A change in an accounting estimate is:<br>A)

Q134: On April 1, Year 1, Astor Corp.

Q138: Extraordinary repairs are expenditures extending the asset's