Essay

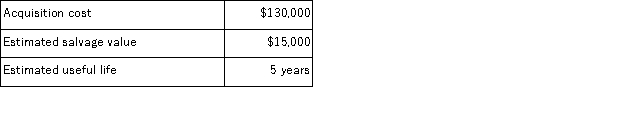

On April 1, Year 1, Astor Corp. purchased and placed a plant asset in service. The following information is available regarding the plant asset:  Make the necessary adjusting journal entries at December 31, Year 1, and December 31, Year 2 to record depreciation for each year under the straight-line depreciation method.

Make the necessary adjusting journal entries at December 31, Year 1, and December 31, Year 2 to record depreciation for each year under the straight-line depreciation method.

Correct Answer:

Verified

[($130,000 - $15,00...

[($130,000 - $15,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: A copyright gives its owner the exclusive

Q57: Holding a copyright:<br>A)Gives its owner the exclusive

Q59: The federal income tax rules for depreciating

Q85: When a company constructs a building, the

Q107: A change in an accounting estimate is:<br>A)

Q116: An asset's book value is $36,000 on

Q130: In Year one, McClintock Co. acquired a

Q132: The Oberon Company purchased a delivery truck

Q136: Since goodwill is an intangible, it is

Q138: A company's property records revealed the following