Essay

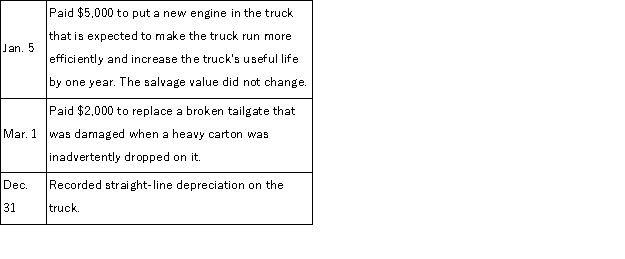

In Year one, McClintock Co. acquired a truck that cost $75,500 with an estimated $14,000 salvage value and 4 year estimated useful life. Depreciation in the first year was $15,375. McClintock had the following transactions involving plant assets during Year 2. Unless otherwise indicated, all transactions were for cash.  Prepare the general journal entries to record these transactions.

Prepare the general journal entries to record these transactions.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: A copyright gives its owner the exclusive

Q59: The federal income tax rules for depreciating

Q116: An asset's book value is $36,000 on

Q129: The depreciation method that charges the same

Q132: The Oberon Company purchased a delivery truck

Q134: On April 1, Year 1, Astor Corp.

Q136: Since goodwill is an intangible, it is

Q157: A _results from revising estimates of

Q184: Obsolescence refers to the insufficient capacity of

Q191: The purchase of a property that included