Essay

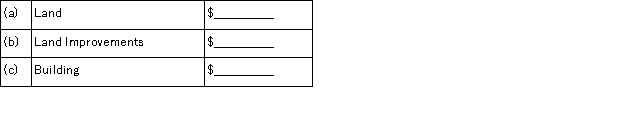

A company paid $595,000 for property that included land appraised at $384,000; land improvements appraised at $128,000; and a building appraised at $288,000. The plan is to use the building as a manufacturing plant. Determine the amounts that should be recorded as:

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Wallace Company had a building that was

Q39: Marks Consulting purchased equipment costing $45,000 on

Q47: Additional costs of plant assets that provide

Q78: Peavey Enterprises purchased a depreciable asset for

Q89: Describe the accounting for natural resources, including

Q97: Wickland Company installs a manufacturing machine in

Q99: Wickland Company installs a manufacturing machine in

Q133: A machine had an original cost of

Q185: Which of the following are not classified

Q189: A machine costing $450,000 with a 4-year