Essay

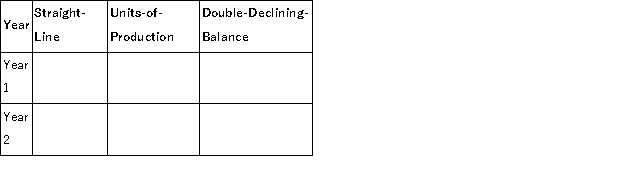

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1. The company estimates the machine will produce 1,050,000 units of product during its life. It actually produces the following units for the first 2 years: Year 1, 260,000; Year 2, 275,000. Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method. Show calculation of amounts below the table.

Correct Answer:

Verified

Straight-line: $450,000 - $30,000/4 = $...

Straight-line: $450,000 - $30,000/4 = $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Wallace Company had a building that was

Q39: Marks Consulting purchased equipment costing $45,000 on

Q47: Additional costs of plant assets that provide

Q78: Peavey Enterprises purchased a depreciable asset for

Q89: Describe the accounting for natural resources, including

Q90: A company purchased a mineral deposit for

Q97: Wickland Company installs a manufacturing machine in

Q133: A machine had an original cost of

Q185: Which of the following are not classified

Q190: A company paid $595,000 for property that