Essay

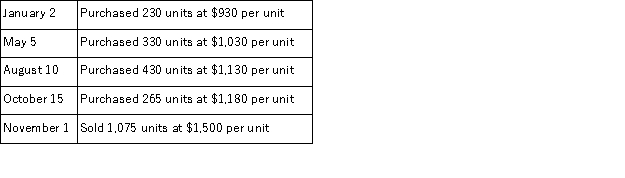

A merchandiser that uses a periodic inventory system made the following cash purchases and sales during the year. There was no beginning inventory.  The company has a calendar year-end and uses the FIFO inventory valuation method. Calculate the ending inventory balance and cost of goods sold for the year.

The company has a calendar year-end and uses the FIFO inventory valuation method. Calculate the ending inventory balance and cost of goods sold for the year.

Correct Answer:

Verified

Ending inventory = 180 × $1,180 = $212,...

Ending inventory = 180 × $1,180 = $212,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: Given the following events, what is the

Q54: The _ is a measure of how

Q55: The reasoning behind the retail inventory method

Q56: A company has inventory of 10 units

Q57: Damaged and obsolete goods:<br>A)Are never included in

Q59: A company markets a climbing kit and

Q61: Toys "R" Us had cost of goods

Q62: Given the following information, determine the cost

Q150: A company had inventory of 5 units

Q230: An advantage of the _ method of