Multiple Choice

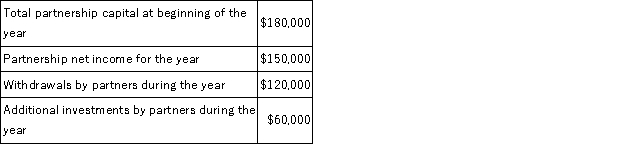

The following information is available on TGR Enterprises, a partnership, for the most recent fiscal year:  There are three partners in TGR Enterprises: Tracey, Gregory and Rodgers. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively, based on their proportionate investments and withdrawals. Compute the ending capital balances of the three partners.

There are three partners in TGR Enterprises: Tracey, Gregory and Rodgers. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively, based on their proportionate investments and withdrawals. Compute the ending capital balances of the three partners.

A) Tracey = $108,000; Gregory = $54,000; Rodgers = $108,000.

B) Tracey = $90,000; Gregory = $90,000; Rodgers = $90,000.

C) Tracey = $204,000; Gregory = $102,000; Rodgers = $204,000.

D) Tracey = $84,000; Gregory = $102,000; Rodgers = $84,000.

E) Tracey = $60,000; Gregory = $30,000; Rodgers = $60,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Identify and discuss the key characteristics of

Q48: A partnership recorded the following journal entry:

Q56: Darien and Hayden agree to accept Kevin

Q64: Maxwell and Smart are forming a partnership.Maxwell

Q72: Henry,Luther,and Gage are dissolving their partnership.Their partnership

Q125: Partnership accounting does not:<br>A)Use a capital account

Q131: An unincorporated association of two or more

Q133: Explain the steps involved in the liquidation

Q134: Fellows and Marshall are partners in an

Q163: Limited liability partnerships are designed to protect