Multiple Choice

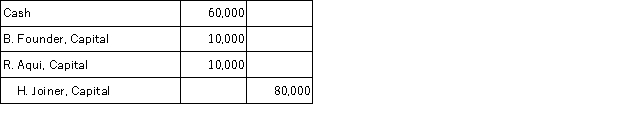

A partnership recorded the following journal entry:  This entry reflects:

This entry reflects:

A) Acceptance of a new partner who invests $60,000 and receives a $20,000 bonus.

B) Withdrawal of a partner who pays a $10,000 bonus to each of the other partners.

C) Addition of a partner who pays a bonus to each of the other partners.

D) Additional investment into the partnership by Founder and Aqui.

E) Withdrawal of $10,000 each by Founder and Aqui upon the admission of a new partner.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Wallace,Simpson,and Prince are partners and share income

Q26: Advantages of a partnership include:<br>A)Limited life.<br>B)Mutual agency.<br>C)Unlimited

Q45: The following information is available on TGR

Q56: Darien and Hayden agree to accept Kevin

Q64: Maxwell and Smart are forming a partnership.Maxwell

Q72: Henry,Luther,and Gage are dissolving their partnership.Their partnership

Q82: Which of the following statements is true?<br>A)Partners

Q125: Partnership accounting does not:<br>A)Use a capital account

Q131: An unincorporated association of two or more

Q134: Fellows and Marshall are partners in an