Multiple Choice

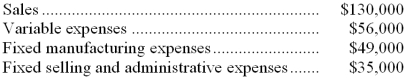

The management of Austin Corporation is considering dropping product R97C. Data from the company's accounting system appear below:

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $34,000 of the fixed manufacturing expenses and $20,000 of the fixed selling and administrative expenses are avoidable if product R97C is discontinued. What would be the effect on the company's overall net operating income if product R97C were dropped?

A) Overall net operating income would increase by $20,000.

B) Overall net operating income would increase by $10,000.

C) Overall net operating income would decrease by $20,000.

D) Overall net operating income would decrease by $10,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: The Tolar Corporation has 400 obsolete desk

Q90: Witch's Brew Company manufactures and sells three

Q91: Brittman Corporation makes three products that use

Q92: Scales Corporation has received a request for

Q93: Iacollia Company makes two products from a

Q94: In a decision to drop a segment,

Q96: The following are the Wyeth Company's unit

Q97: For which of the following decisions are

Q98: Dodge Company makes two products from a

Q100: Oran Refiners, Inc., processes sugar cane that