Essay

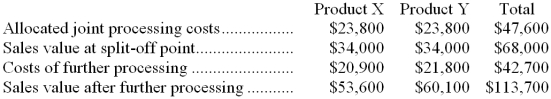

Iacollia Company makes two products from a common input. Joint processing costs up to the split-off point total $47,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

Required:

a. What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point?

b. What is the net monetary advantage (disadvantage) of processing Product Y beyond the split-off point?

c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Correct Answer:

Verified

Correct Answer:

Verified

Q88: A merchandising company that buys all of

Q89: Rosiek Corporation uses part A55 in one

Q90: Witch's Brew Company manufactures and sells three

Q91: Brittman Corporation makes three products that use

Q92: Scales Corporation has received a request for

Q94: In a decision to drop a segment,

Q95: The management of Austin Corporation is considering

Q96: The following are the Wyeth Company's unit

Q97: For which of the following decisions are

Q98: Dodge Company makes two products from a