Multiple Choice

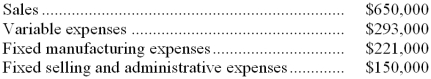

The management of Dorl Corporation has been concerned for some time with the financial performance of its product I54J and has considered discontinuing it on several occasions. Data from the company's accounting system appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $95,000 of the fixed manufacturing expenses and $85,000 of the fixed selling and administrative expenses are avoidable if product I54J is discontinued.

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $95,000 of the fixed manufacturing expenses and $85,000 of the fixed selling and administrative expenses are avoidable if product I54J is discontinued.

-What would be the effect on the company's overall net operating income if product I54J were dropped?

A) Overall net operating income would decrease by $177,000.

B) Overall net operating income would increase by $177,000.

C) Overall net operating income would increase by $14,000.

D) Overall net operating income would decrease by $14,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Badal Corporation processes sugar beets in batches.

Q2: Consider the following statements:<br>I. A vertically integrated

Q3: Creelman Company makes four products in a

Q5: A study has been conducted to determine

Q6: In deciding whether to manufacture a part

Q7: A sunk cost is a cost that

Q8: Closter Corporation makes three products that use

Q9: One of the dangers of allocating common

Q10: Kleffman Corporation is presently making part X31

Q11: The management of Dorl Corporation has been