Multiple Choice

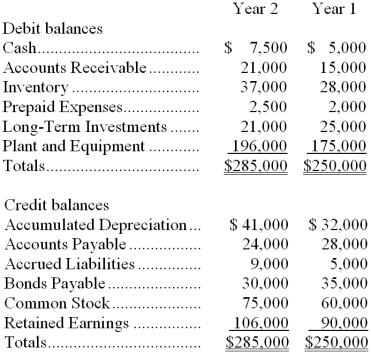

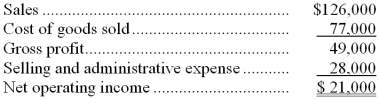

Balance sheet accounts for Hollis, Inc. contained the following amounts at the ends of years 1 and 2:  The company's income statement for year 2 follows:

The company's income statement for year 2 follows:  There were no sales or retirements of plant and equipment in Year 2. Cash dividends of $5,000 were paid during Year 2. The company pays no income taxes. The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows.

There were no sales or retirements of plant and equipment in Year 2. Cash dividends of $5,000 were paid during Year 2. The company pays no income taxes. The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows.

-For Year 2, sales adjusted to a cash basis would be:

A) $111,000

B) $120,000

C) $126,000

D) $132,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Sitz Corporation's most recent comparative balance sheet

Q3: Menz Corporation's balance sheet and income statement

Q4: Last year Cumley Company reported a cost

Q5: Hardey Corporation's balance sheet and income statement

Q6: Last year Madson Company reported a cost

Q7: Balance sheet accounts for Hollis, Inc. contained

Q8: During the year the balance in the

Q9: Colley Corporation's balance sheet and income statement

Q10: Graciana Corporation's most recent comparative balance sheet

Q11: Van Cleef Company's comparative balance sheet and