Essay

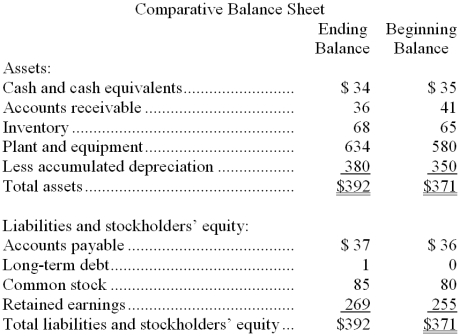

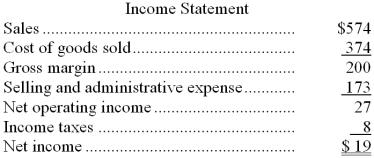

Menz Corporation's balance sheet and income statement appear below:

Cash dividends were $5.

Required:

Prepare the operating activities section of the statement of cash flows in good form using the direct method.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Sitz Corporation's most recent comparative balance sheet

Q2: Balance sheet accounts for Hollis, Inc. contained

Q4: Last year Cumley Company reported a cost

Q5: Hardey Corporation's balance sheet and income statement

Q6: Last year Madson Company reported a cost

Q7: Balance sheet accounts for Hollis, Inc. contained

Q8: During the year the balance in the

Q9: Colley Corporation's balance sheet and income statement

Q10: Graciana Corporation's most recent comparative balance sheet

Q11: Van Cleef Company's comparative balance sheet and