Multiple Choice

A Ltd sold an item of plant to B Ltd on 1 January 20X7 for $25 000. The asset had cost A Ltd $30 000 when acquired on 1 January 20X5. At that time the useful life of the plant was assessed at 6 years. The consolidation elimination entries at 30 June 20X7 in relation to the sale of plant is (rounded to nearest dollar) :

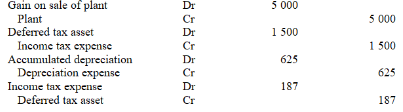

A)

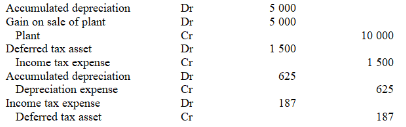

B)

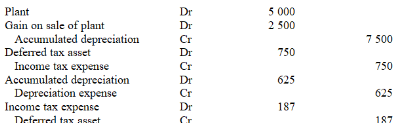

C)

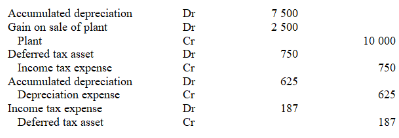

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: When a subsidiary declares a final dividend

Q3: Janus Limited,a subsidiary entity,sold a non-current asset

Q3: When an entity sells a non-current asset

Q3: Jameson purchased goods from its subsidiary for

Q4: If a dividend is paid out of

Q10: A consolidation worksheet adjustment to eliminate the

Q10: A subsidiary entity sold inventory to its

Q11: On 16 May 20X4, Z Ltd sold

Q14: When eliminating an intragroup service which of

Q18: A Ltd sold an item of plant