Multiple Choice

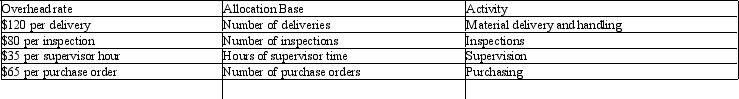

Jones Construction currently uses traditional costing where overhead is applied based on direct labor hours. Using traditional costing, the applied overhead rate is $24 per direct labor hour. They are considering a switch to activity-based costing (ABC) . The company controller has come up with preliminary overhead rates for each of the following activities: One of the company's current jobs has the following information available:

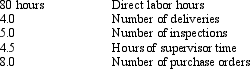

One of the company's current jobs has the following information available: Which of the following statements is true when comparing the total overhead allocated to the job using traditional versus ABC costing?

Which of the following statements is true when comparing the total overhead allocated to the job using traditional versus ABC costing?

A) ABC costing will yield $362.50 less in overhead cost being allocated to the job.

B) ABC costing will yield $725.50 less in overhead cost being allocated to the job.

C) ABC costing will yield $345.50 more in overhead cost being allocated to the job.

D) ABC costing will yield $725.50 more in overhead cost being allocated to the job.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which of the following would be the

Q11: What are the benefits and limitations of

Q12: Aunt Lucy's Candies Aunt Lucy's Candies sells

Q13: Which of the following statements is false

Q14: Which of the following statements is true

Q16: Thurman Brothers Construction manufactures and installs standard

Q17: Can activity-based costing (ABC) be used by

Q18: What is meant by the term "activity"

Q19: Herndon Brothers Inc. produces a variety of

Q20: Define "cross subsidies" and tell what kind