Essay

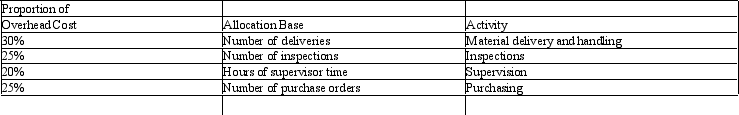

Thurman Brothers Construction manufactures and installs standard and custom-made cabinetry for residential homes. Last year, the company incurred $600,000 in overhead costs when a total of 10,000 direct labor hours were incurred. After implementing activity-based costing (ABC), the company's accountant identified the following related information:

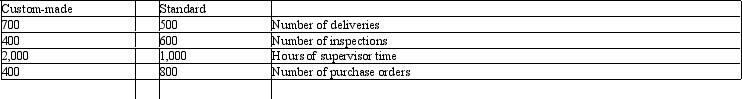

The number of activities for standard and custom-made cabinets is as follows:

The number of activities for standard and custom-made cabinets is as follows:

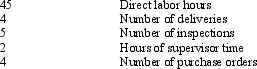

During the past year, Thurman accepted a customer order for a set of custom-made cabinets that would require the following:

During the past year, Thurman accepted a customer order for a set of custom-made cabinets that would require the following:

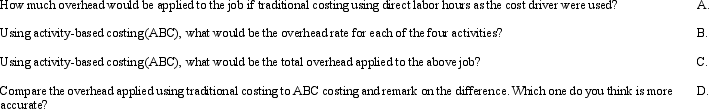

Required:

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q11: What are the benefits and limitations of

Q12: Aunt Lucy's Candies Aunt Lucy's Candies sells

Q13: Which of the following statements is false

Q14: Which of the following statements is true

Q15: Jones Construction currently uses traditional costing where

Q17: Can activity-based costing (ABC) be used by

Q18: What is meant by the term "activity"

Q19: Herndon Brothers Inc. produces a variety of

Q20: Define "cross subsidies" and tell what kind

Q21: Discuss how the shift from labor intensive