Multiple Choice

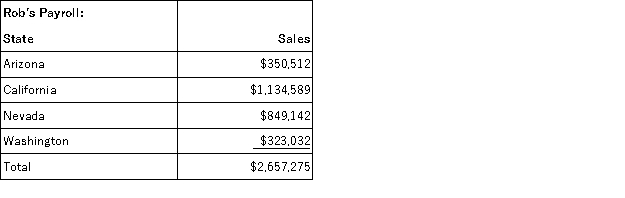

Handsome Rob provides transportation services in several western states. Rob has sales as follows:

Rob is a California Corporation and has the following facts.

Rob has nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California based drivers. What is Rob's California sale numerator?

A) $934,589

B) $1,134,589

C) $1,215,347

D) $2,657,275

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Which of the following is true regarding

Q21: Roxy operates a dress shop in Arlington,

Q34: Businesses must collect sales tax only in

Q55: Assume Tennis Pro discovered that one salesman

Q57: Which of the following statements regarding income

Q95: The property factor is generally the average

Q100: All 50 states impose a sales and

Q104: Super Sadie, Incorporated manufactures sandals and distributes

Q106: Gordon operates the Tennis Pro Shop in

Q137: Which of the following is not a