Short Answer

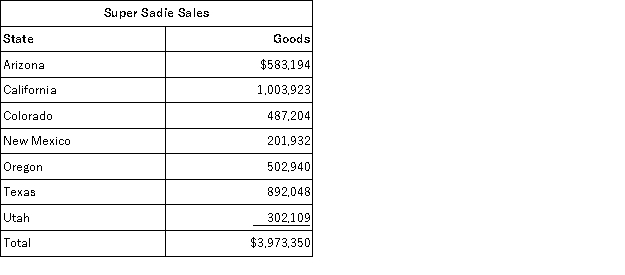

Super Sadie, Incorporated manufactures sandals and distributes them across the southwestern United States. Assume that Super Sadie has sales and use tax nexus in Arizona, California, Colorado, New Mexico, and Texas. Super Sadie has sales as follows:

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Oregon (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number)

Correct Answer:

Verified

$233,900.

Explanation: ($583,1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation: ($583,1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Which of the following is true regarding

Q19: Which of the following is not a

Q21: Roxy operates a dress shop in Arlington,

Q43: Gordon operates the Tennis Pro Shop in

Q57: Which of the following statements regarding income

Q69: What was the Supreme Court's holding in

Q95: The property factor is generally the average

Q100: All 50 states impose a sales and

Q101: Handsome Rob provides transportation services in several

Q106: Gordon operates the Tennis Pro Shop in