Multiple Choice

During the year ended 30 June 2014,a subsidiary sold inventory to a parent for $90 000.The inventory had previously cost the subsidiary entity $72 000.By 30 June 2014 the parent had sold 75% of the inventory to a party outside the group.The remaining inventory was sold externally in July 2014.The company tax rate is 30%.Which of the following is the adjustment entry in the consolidation worksheet at 30 June 2015?

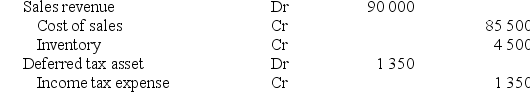

A)

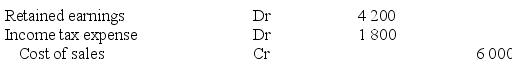

B)

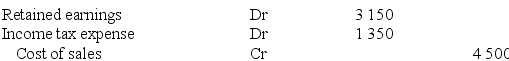

C)

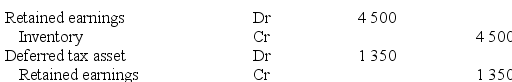

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A parent entity sold a depreciable non-current

Q37: The effect of an intragroup sale of

Q38: The effect of an intragroup sale of

Q40: The effect of an intragroup sale of

Q41: A subsidiary sold inventory to its parent

Q42: Where an intragroup sale of an asset

Q43: A parent sold some inventory to its

Q44: On 16 May 2014,Zebra Ltd sold equipment

Q46: Where there is an intragroup sale of

Q48: Elimination consolidation entries relating to intragroup services