Multiple Choice

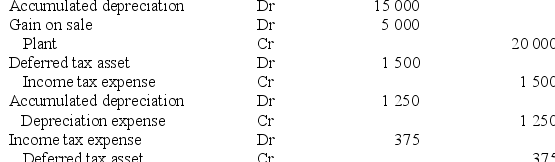

Abra Ltd sold an item of plant to its subsidiary Cadabra Ltd on 1 January 2017 for $50 000.The asset had cost Abra Ltd $60 000 when acquired on 1 January 2015.At that time the useful life of the plant was assessed at 6 years.Rounded to the nearest dollar,the consolidation elimination entries at 30 June 2017 in relation to the sale of plant are which of the following?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q16: When a depreciable non-current asset is sold

Q20: A consolidation worksheet adjustment to eliminate the

Q23: The effect of an intragroup sale of

Q24: A subsidiary entity sold goods to its

Q27: During the year ended 30 June 2014,a

Q28: During the year ended 30 June 2017,a

Q29: Sky Limited, a subsidiary entity, sold a

Q35: Where a dividend is declared in a

Q36: When an entity sells a non-current asset

Q47: Ali Ltd sold an item of plant