Multiple Choice

During the year ended 30 June 2017,a parent entity rents a warehouse from a subsidiary entity for $200 000.The company tax rate is 30%.Which of the following is the consolidation adjustment entry needed at reporting date to eliminate the transaction?

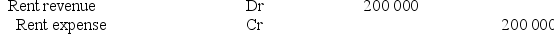

A)

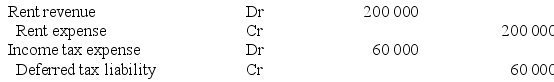

B)

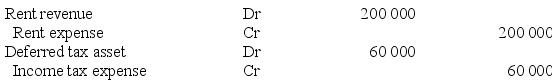

C)

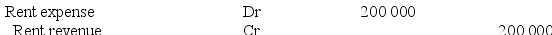

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Which of the following items is an

Q16: When a depreciable non-current asset is sold

Q20: A consolidation worksheet adjustment to eliminate the

Q23: The effect of an intragroup sale of

Q24: A subsidiary entity sold goods to its

Q26: Abra Ltd sold an item of plant

Q27: During the year ended 30 June 2014,a

Q29: Sky Limited, a subsidiary entity, sold a

Q32: Knights Ltd purchased inventory from its subsidiary,Gidley

Q36: When an entity sells a non-current asset