Multiple Choice

Exhibit 7.3

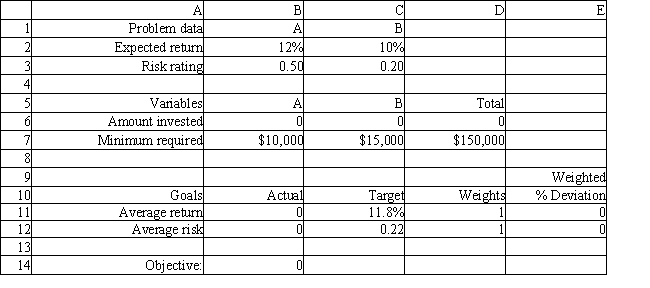

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following minimax formulation of the problem has been solved in Excel.

-Refer to Exhibit 7.3. Which value should the investor change, and in what direction, if he wants to reduce the risk of the portfolio?

A) D11, increase

B) D12, increase

C) C12, increase

D) D12, decrease

Correct Answer:

Verified

Correct Answer:

Verified

Q26: A company wants to purchase large and

Q27: Exhibit 7.2<br>The following questions are based on

Q28: A hard constraint<br>A) cannot be violated<br>B) may

Q29: A company makes 2 products A and

Q30: Goal programming (GP) is typically<br>A) a minimization

Q32: Goal programming (GP) is:<br>A) iterative<br>B) inaccurate<br>C) static<br>D)

Q33: Trade-offs in goal programming can be made

Q34: The MINIMAX objective<br>A) yields the smallest possible

Q35: One major advantage of goal programming (GP)

Q36: An investor wants to invest $50,000 in