Essay

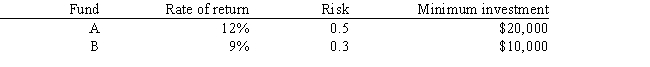

An investor wants to invest $50,000 in two mutual funds, A and B. The rates of return, risks and minimum investment requirements for each fund are:  Note that a low Risk rating means a less risky investment. The investor can invest to maximize the expected rate of return or minimize risk. Any money beyond the minimum investment requirements can be invested in either fund.

Note that a low Risk rating means a less risky investment. The investor can invest to maximize the expected rate of return or minimize risk. Any money beyond the minimum investment requirements can be invested in either fund.

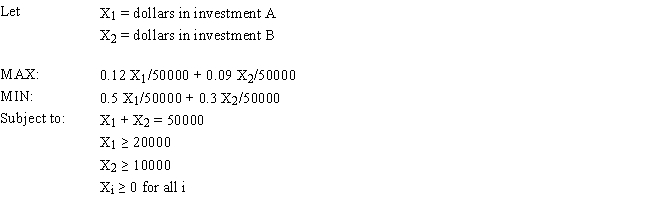

The following is the MOLP formulation for this problem:  The solution for the second LP is (X1, X2) = (20,000, 30,000).

The solution for the second LP is (X1, X2) = (20,000, 30,000).

What formulas should go in cells B2:D11 of the spreadsheet? NOTE: Formulas are not required in all of these cells.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Exhibit 7.3<br>The following questions are based on

Q32: Goal programming (GP) is:<br>A) iterative<br>B) inaccurate<br>C) static<br>D)

Q33: Trade-offs in goal programming can be made

Q34: The MINIMAX objective<br>A) yields the smallest possible

Q35: One major advantage of goal programming (GP)

Q37: Exhibit 7.4<br>The following questions are based on

Q38: Exhibit 7.4<br>The following questions are based on

Q39: An investor wants to invest $50,000 in

Q40: In the goal programming problem, the weights,

Q41: Goal programming problems<br>A) typically include a set