Multiple Choice

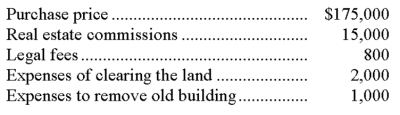

A company purchased property for a building site. The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

A) $175,800 to Land; $18,800 to Building.

B) $190,000 to Land; $3,800 to Building.

C) $190,800 to Land; $1,000 to Building.

D) $192,800 to Land; $0 to Building.

E) $193,800 to Land; $0 to Building.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The formula for computing annual straight-line depreciation

Q20: On April 1 of the current year,a

Q21: Depreciation measures the actual decline in market

Q46: A company paid $770,000 plus $5,000 in

Q48: A company had net sales of $230,000

Q54: On January 2, 2007, a company purchased

Q65: A company exchanged an old truck for

Q91: Record the following events and transactions for

Q165: How is the cost principle applied to

Q224: Explain the impact, if any, on depreciation