Not Answered

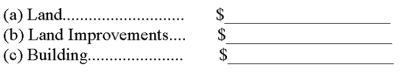

A company paid $770,000 plus $5,000 in closing costs for property that included land appraised at $384,000; land improvements appraised at $128,000; and a building appraised at $288,000. The plan is to use the building as a manufacturing plant. Determine the amounts that should be recorded as:

Correct Answer:

Verified

Correct Answer:

Verified

Q20: On April 1 of the current year,a

Q21: Depreciation measures the actual decline in market

Q25: During the current year,a company acquired a

Q43: A company purchased an equipment system for

Q48: A company had net sales of $230,000

Q49: A company purchased property for a building

Q65: A company exchanged an old truck for

Q91: Record the following events and transactions for

Q94: Big River Rafting pays $310,000 plus $15,000

Q165: How is the cost principle applied to