Essay

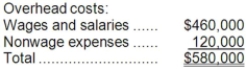

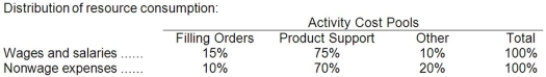

Goel Company, a wholesale distributor, uses activity-based costing for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The amount of activity for the year is as follows:  Required:

Required:

Compute the activity rates (i.e., cost per unit of activity) for the Filling Orders and Product Support activity cost pools:

Correct Answer:

Verified

Correct Answer:

Verified

Q6: An action analysis report reconciles activity-based costing

Q7: To the nearest whole dollar, how much

Q8: If a cost object such as a

Q9: What would be the total overhead cost

Q10: If a cost object such as a

Q11: If a cost object such as a

Q12: According to the activity-based costing system, what

Q13: What would be the total overhead cost

Q14: Suppose an action analysis report is prepared

Q15: Hasty Hardwood Floors installs oak and other