Essay

Three transactions described below were completed during 2016 by Story Company.

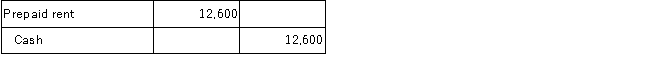

A.On June 1, 2016, Story Company paid $12,600 for one year's rent beginning on that date.The rent payment was recorded as follows:

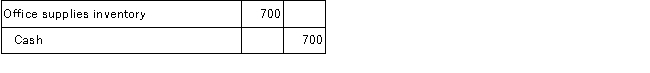

B.On February 1, 2016, Story Company purchased office supplies during the year that cost $700 and placed the supplies in a storeroom for use as needed.The purchase was recorded as follows:

At December 31, 2016, a count showed unused office supplies of $200 in the storeroom.There was no beginning inventory of supplies on hand.

At December 31, 2016, a count showed unused office supplies of $200 in the storeroom.There was no beginning inventory of supplies on hand.

C.On December 31, 2016, Story Company owed employees $2,000 for wages earned during December.These wages had not been paid or recorded.Required:

Prepare the adjusting entries as of December 31, 2016, assuming no adjusting entries have been made during the year.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Lane Company is completing the accounting cycle

Q31: On September 1, 2016, Fast Track, Inc.

Q32: Earnings per share are calculated by dividing

Q34: Which of the following accounts would not

Q36: Determine the effect of the following errors

Q37: Which of the following statements is inaccurate

Q48: Explain how adjusting entries provide for potential

Q79: Accounts that retain their balance from one

Q95: What does the total asset turnover ratio

Q115: Accrued revenues are revenues that have been