Essay

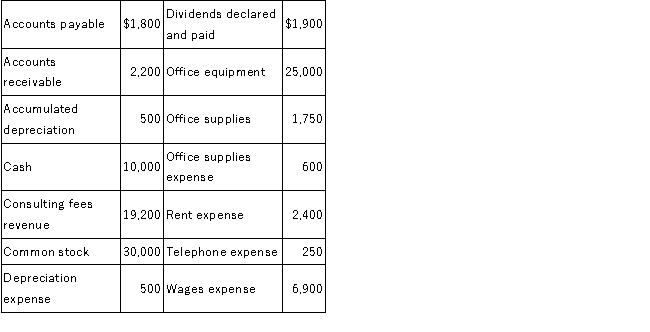

On September 1, 2016, Fast Track, Inc. was started with $30,000 invested by the owners as contributed capital. On September 30, 2016, the accounting records contained the following amounts:  Required:

Required:

Prepare a single-step income statement for September for the first month of Fast Track's operation. Ignore income taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: On November 1, 2016, Bruce Company leased

Q27: Which of the following correctly describes the

Q29: Lane Company is completing the accounting cycle

Q32: Earnings per share are calculated by dividing

Q33: Three transactions described below were completed during

Q34: Which of the following accounts would not

Q36: Determine the effect of the following errors

Q48: Explain how adjusting entries provide for potential

Q79: Accounts that retain their balance from one

Q95: What does the total asset turnover ratio