Multiple Choice

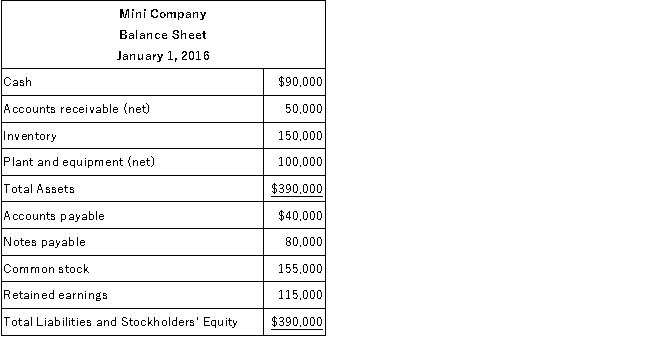

The balance sheet of Mini Company was as follows immediately before it was acquired by Maxi Company:  On January 1, 2016, in a merger transaction, Maxi Company paid $350,000 in cash for 100% of the outstanding common stock of Mini Company. The fair value of Mini Company's plant and equipment was $140,000 on the date of acquisition. If the fair value and book value are the same for Mini's remaining assets and liabilities, what is the net increase in Maxi's assets only, after paying the cash for Mini?

On January 1, 2016, in a merger transaction, Maxi Company paid $350,000 in cash for 100% of the outstanding common stock of Mini Company. The fair value of Mini Company's plant and equipment was $140,000 on the date of acquisition. If the fair value and book value are the same for Mini's remaining assets and liabilities, what is the net increase in Maxi's assets only, after paying the cash for Mini?

A) $430,000.

B) $470,000.

C) $120,000.

D) $390,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Libby Company purchased equity securities for $100,000

Q63: Phillips Corporation purchased 1,000,000 shares of Martin

Q64: Rye Company purchased 15% of Lena Company's

Q65: Passive investments other than held-to-maturity investments are

Q66: During 2016, Manning Corporation purchased 100% of

Q68: On April 1, 2017, Paxton Corporation acquired

Q69: On January 1, 2016, Presto Corporation purchased,

Q70: JDR Company purchased 40% of the common

Q71: On January 1, 2016, Short Company purchased

Q84: Management must have the intent and ability