Essay

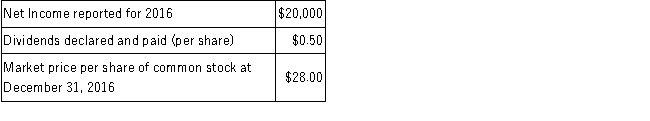

On January 1, 2016, Presto Corporation purchased, as a long-term investment, 5,000 shares of the outstanding voting common stock of Shazam Corporation at $30 per share. During 2016, the following events occurred at Shazam Corporation:  Required:

Required:

A. Prepare the journal entry for Presto Corporation to record the investment (use an account titled "Long-term investment").

B. Assume two independent situations, Case A for 5,000 shares as 10% ownership and Case B for 5,000 shares as 40% ownership. For each situation, prepare the following entries:

1. To recognize net income for 2016.

2. To record cash dividend declared and received.

3. To record any adjustment to market price of stock at year-end.

A.Prepare the journal entry for Presto Corporation to record the investment (use an account titled "Long-term investment").

B.Assume two independent situations, Case A for 5,000 shares as 10% ownership and Case B for 5,000 shares as 40% ownership.For each situation, prepare the following entries:

1.To recognize net income for 2016.2.To record cash dividend declared and received.3.To record any adjustment to market price of stock at year-end.

Correct Answer:

Verified

Correct Answer:

Verified

Q64: Rye Company purchased 15% of Lena Company's

Q65: Passive investments other than held-to-maturity investments are

Q66: During 2016, Manning Corporation purchased 100% of

Q67: The balance sheet of Mini Company was

Q68: On April 1, 2017, Paxton Corporation acquired

Q70: JDR Company purchased 40% of the common

Q71: On January 1, 2016, Short Company purchased

Q73: Any unrealized gains or losses on trading

Q74: On July 1, 2016, as a long-term

Q84: Management must have the intent and ability