Essay

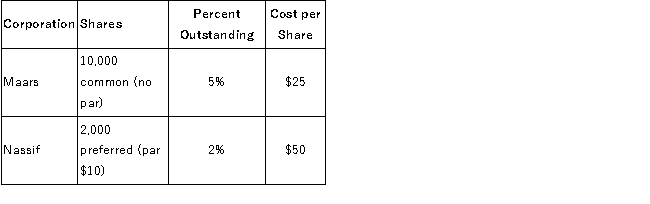

On January 1, 2016, Heitzman Company purchased the following shares of stock as a long-term investment in available-for-sale securities:  The fair value of the stocks subsequently were as follows:

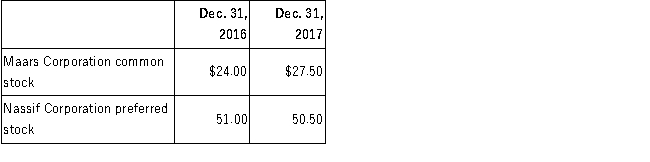

The fair value of the stocks subsequently were as follows:  Required:

Required:

Calculate the "Net unrealized gains/losses," at both December 31, 2016 and December 31, 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: On January 1, 2016, Calas Company acquired

Q6: An unrealized holding loss is reported on

Q7: Photo Finish Corporation bought a 40% interest

Q8: On January 1, 2016, Sheldon Company paid

Q11: Goodwill is reported on a consolidated balance

Q26: Investments in bonds intended to be sold

Q29: How is goodwill accounted for subsequent to

Q35: When accounting for investments in trading securities,any

Q79: Madison Inc.acquires 100% of the voting stock

Q97: Ocean Corporation owns 30% of Woods Corp.for