Multiple Choice

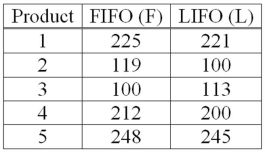

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the value of calculated t?

What is the value of calculated t?

A) +0.933

B) ±2.776

C) +0.47

D) -2.028

Correct Answer:

Verified

Correct Answer:

Verified

Q29: If we are testing for the difference

Q32: When dependent samples are used to test

Q42: When independent samples with unknown but equal

Q44: In one class, a statistics professor wants

Q56: When testing the difference between two population

Q58: When is it appropriate to use the

Q70: When testing for a difference between the

Q78: The paired difference test has _ degrees

Q110: A study by a bank compared the

Q114: Accounting procedures allow a business to evaluate