Multiple Choice

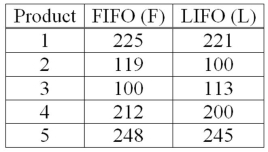

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

A) Fail to reject the null hypothesis and conclude LIFO is more effective.

B) Reject the null hypothesis and conclude LIFO is more effective.

C) Reject the alternate hypothesis and conclude LIFO is more effective.

D) Fail to reject the null hypothesis.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: When the population standard deviations are unknown,

Q29: If we are testing for the difference

Q32: When dependent samples are used to test

Q42: When independent samples with unknown but equal

Q44: In one class, a statistics professor wants

Q56: When testing the difference between two population

Q58: When is it appropriate to use the

Q70: When testing for a difference between the

Q110: A study by a bank compared the

Q113: Accounting procedures allow a business to evaluate