Multiple Choice

Scenario 13.2 Assume the following conditions hold. Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks.This acts to lower the equilibrium interest rate by 2 percent.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks.This acts to lower the equilibrium interest rate by 2 percent.  Refer to Scenario 13.1.What is the ultimate change in the money supply following the open market operation by the Fed?

Refer to Scenario 13.1.What is the ultimate change in the money supply following the open market operation by the Fed?

A) -$3 billion

B) -$0.33 billion

C) +$1 billion

D) +$2.01 billion

E) +$5.2 billion

Correct Answer:

Verified

Correct Answer:

Verified

Q62: The table given below shows the assets

Q63: Other things equal, when the Fed raises

Q64: Which of the following is true of

Q65: All members of the Federal Board of

Q66: The interest rate that banks pay for

Q68: Table 13.1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2060/.jpg" alt="Table 13.1

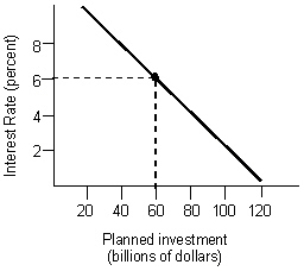

Q69: The figure given below depicts the equilibrium

Q70: The Fed can enhance liquidity in the

Q71: If the money supply is $80 billion,

Q72: When the government raises spending to promote