Essay

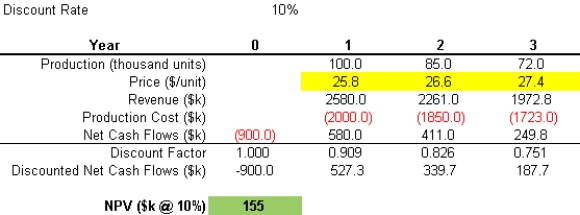

A firm is considering investing $0.9M in a typical industrial manufacturing application with a three-year production planning cycle under a forecasted market price environment. A simple three-period project pro forma cash flow sheet for this project is shown below:  In the pro forma, the production and price forecast in each period translate to revenue, which can then be netted of production costs to arrive at the expected cash flow in each period. The cash flows are then discounted at a rate that is commensurate with the riskiness of the project (here, assumed to be 10%).

In the pro forma, the production and price forecast in each period translate to revenue, which can then be netted of production costs to arrive at the expected cash flow in each period. The cash flows are then discounted at a rate that is commensurate with the riskiness of the project (here, assumed to be 10%).

-The Net Present Value (NPV) is the sum of the discounted cash flows. What is the NPV of the project, including the required investment?

Correct Answer:

Verified

Including the requir...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: What is the appropriate distribution for the

Q3: Which of the following is a popular

Q5: The amount of variability of a financial

Q6: Suppose that a recent study shows that

Q8: Perform a simulation assuming the plant will

Q9: Which @RISK function can be used to

Q11: Assume that one of the bidders bids

Q17: A common distribution for modeling product lifetimes

Q20: The @RISK function RISKUNIFORM (0,1)is essentially equivalent

Q31: The random nature of games of chance