Essay

Southport Mining Corporation is considering a new mining venture in Indonesia. There are two uncertainties associated with this prospect; the metallurgical properties of the ore and the net price (market price minus mining and transportation costs) of the ore in the future.

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

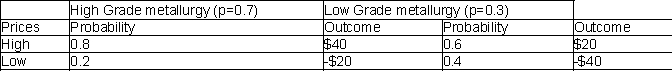

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

-Since the core test can only sample a small part of the mine, Southport's geologists believe it is somewhat unrealistic to view it as a perfectly reliable test. Based on similar tests they have conducted in the past, they believe that if the metallurgical properties of the ore are actually High Grade, then the probability that this test will return "favorable" results is 0.95. If the metallurgical properties are Low Grade, the probability that this test will return "favorable" results is only 0.25. Otherwise, the test results will be considered "unfavorable". Given this information, what are the posterior probabilities that the ore will be a High Grade and Low Grade, given the core test report?

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Bayes' rule can be used for updating

Q23: The solution procedure that was introduced in

Q24: Why is there a kink in the

Q25: Ms. Rich has just bought a new

Q27: Ms. Rich has just bought a new

Q29: The following is a payoff table giving

Q30: A risk profile from PrecisionTree lists:<br>A) the

Q31: Using a strategy region graph, determine what

Q45: Should the credit union purchase the report

Q71: The expected monetary value represents a long-run