Multiple Choice

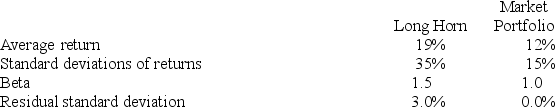

The following data are available relating to the performance of Long Horn Stock Fund and the market portfolio:

The risk-free return during the sample period was 6%.

What is the Treynor measure of performance evaluation for Long Horn Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.3143

E) 0.3714

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Suppose two portfolios have the same average

Q27: Suppose the risk-free return is 4%. The

Q28: Morningstar's RAR methodI) is one of the

Q39: In measuring the comparative performance of different

Q66: Henriksson (1984) found that, on average, betas

Q67: To determine whether portfolio performance is statistically

Q68: _ did not develop a popular method

Q69: In a particular year, Aggie Mutual Fund

Q70: Suppose two portfolios have the same average

Q78: The following data are available relating to