Multiple Choice

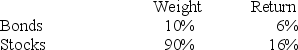

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:

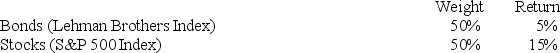

The return on a bogey portfolio was 10%, calculated as follows:

The contribution of asset allocation across markets to the total excess return was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Suppose the risk-free return is 4%. The

Q28: Suppose two portfolios have the same average

Q28: Morningstar's RAR methodI) is one of the

Q67: To determine whether portfolio performance is statistically

Q68: _ did not develop a popular method

Q70: Rodney holds a portfolio of risky assets

Q70: Suppose two portfolios have the same average

Q72: A pension fund that begins with $500,000

Q73: The following data are available relating to

Q77: A portfolio manager's ranking within a comparison