Multiple Choice

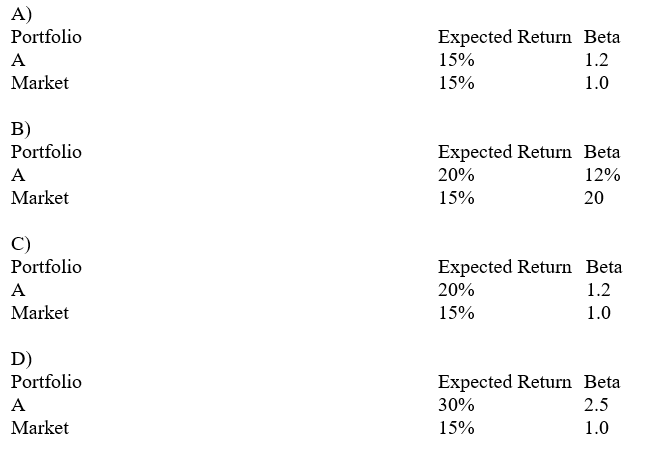

If the simple CAPM is valid and all portfolios are priced correctly, which of the situations below is possible? Consider each situation independently, and assume the risk-free rate is 5%.

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q55: There are two independent economic factors, M1

Q56: According to the CAPM, investors are compensated

Q57: The expected return on the market portfolio

Q58: Investors require a risk premium as compensation

Q59: According to capital asset pricing theory, the

Q61: Consider the single factor APT. Portfolio A

Q62: The measure of risk used in the

Q63: An investor should do which of the

Q64: A stock's alpha measures the stock's _.<br>A)

Q65: According to the capital asset pricing model,