Multiple Choice

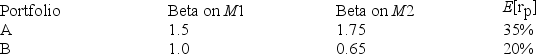

There are two independent economic factors, M1 and M2. The risk-free rate is 5%, and all stocks have independent firm-specific components with a standard deviation of 25%. Portfolios A and B are well diversified. Given the data below, which equation provides the correct pricing model?

A) E(rP) = 5 + 1.12βP1 + 11.86βP2

B) E(rP) = 5 + 4.96βP1 + 13.26βP2

C) E(rP) = 5 + 3.23βP1 + 8.46βP2

D) E(rP) = 5 + 8.71βP1 + 9.68βP2

Correct Answer:

Verified

Correct Answer:

Verified

Q50: In a simple CAPM world which of

Q51: In a single-factor market model the beta

Q52: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6474/.jpg" alt=" What is the

Q53: According to the CAPM, which of the

Q54: Building a zero-investment portfolio will always involve

Q56: According to the CAPM, investors are compensated

Q57: The expected return on the market portfolio

Q58: Investors require a risk premium as compensation

Q59: According to capital asset pricing theory, the

Q60: If the simple CAPM is valid and