Essay

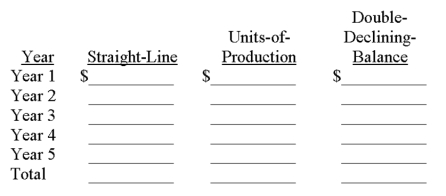

A company purchased a machine on January 1 of the current year for $750,000. Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours, with a residual value of $75,000). During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The first step in accounting for an

Q162: _ expenditures that make an item of

Q163: A company had a building destroyed by

Q164: Gain or loss on the disposal of

Q166: The original cost of a machine was

Q168: A company purchased equipment on July 3

Q169: On April 1, Year 5 a company

Q170: A company's old machine that cost $40,000

Q171: _ refers to an item of property,

Q172: A machine costing $450,000 with a four-year