Essay

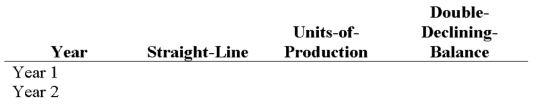

A machine costing $450,000 with a four-year life and an estimated $30,000 residual value is installed by Lux Company on January 1. The factory estimates the machine will produce 1,050,000 units of product during its life. It actually produces the following units for the first 2 years: Year 1, 260,000; Year 2, 275,000. Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method. Show calculation of amounts below the table.

Correct Answer:

Verified

Straight-line: $450,000-30,000/4 = $105,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q167: A company purchased a machine on January

Q168: A company purchased equipment on July 3

Q169: On April 1, Year 5 a company

Q170: A company's old machine that cost $40,000

Q171: _ refers to an item of property,

Q173: Property, plant and equipment include:<br>A) Land.<br>B) Land

Q174: A depreciation method that produces larger depreciation

Q175: The cost of land can include:<br>A) Purchase

Q176: What are some of the variables that

Q177: Marble Company purchased a machine costing $120,000,