Multiple Choice

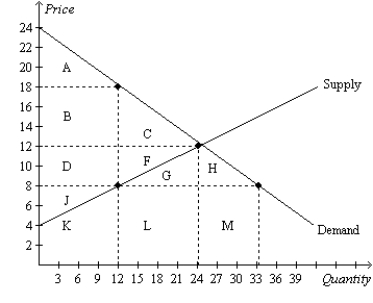

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.The decrease in consumer and producer surpluses that is not offset by tax revenue is the area

A) C.

B) F.

C) G.

D) C+F.

Correct Answer:

Verified

Correct Answer:

Verified

Q74: Figure 8-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-11

Q75: Figure 8-3<br>The vertical distance between points A

Q76: Figure 8-9<br>The vertical distance between points A

Q77: A tax levied on the sellers of

Q78: Figure 8-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-11

Q80: The supply curve for whiskey is the

Q81: Deadweight loss is the<br>A)decline in total surplus

Q82: Figure 8-6<br>The vertical distance between points A

Q83: When a tax is levied on buyers,the<br>A)supply

Q84: Figure 8-6<br>The vertical distance between points A