Multiple Choice

Figure 8-8

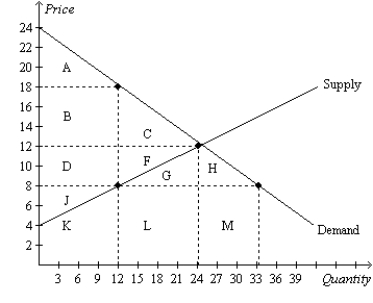

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.One effect of the tax is to

A) reduce consumer surplus from $180 to $72.

B) reduce producer surplus from $96 to $24.

C) create a deadweight loss of $72.

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: A deadweight loss is a consequence of

Q12: Figure 8-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-11

Q13: A tax placed on buyers of tuxedoes

Q14: It does not matter whether a tax

Q15: Figure 8-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-11

Q18: Figure 8-2<br>The vertical distance between points A

Q19: Figure 8-8<br>Suppose the government imposes a $10

Q20: Figure 8-2<br>The vertical distance between points A

Q175: Figure 8-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-1

Q186: Scenario 8-1<br>Erin would be willing to pay