Multiple Choice

Figure 8-11

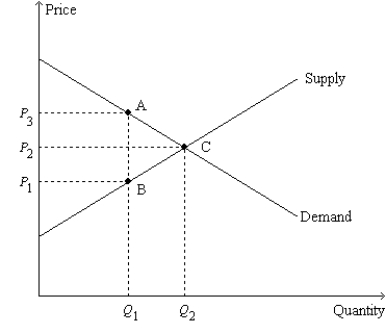

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

A) the government collects $28 in tax revenue.

B) producer surplus decreases by $13.

C) consumer surplus decreases by $11.

D) the deadweight loss amounts to $9.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: If a tax shifts the demand curve

Q26: Figure 8-20<br>On the vertical axis of each

Q31: Scenario 8-1<br>Erin would be willing to pay

Q40: Figure 8-26 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-26

Q51: Figure 8-14 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-14

Q52: When a tax is levied on a

Q92: Figure 8-7<br>The vertical distance between points A

Q197: Figure 8-6<br>The vertical distance between points A

Q226: Suppose Rebecca needs a dog sitter so

Q312: When the government imposes taxes on buyers