Multiple Choice

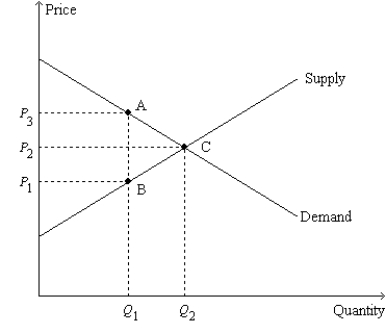

Figure 8-11

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

A) consumer surplus decreases by $11.

B) producer surplus decreases by $11.

C) the deadweight loss amounts to $6.

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: When the price of a good is

Q58: Supply-side economics is a term associated with

Q103: A tax raises the price received by

Q109: To fully understand how taxes affect economic

Q110: If the size of a tax doubles,

Q165: Figure 8-6<br>The vertical distance between points A

Q172: The Social Security tax is a labor

Q174: Figure 8-12 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-12

Q202: The demand for beer is more elastic

Q232: Figure 8-9<br>The vertical distance between points A