Multiple Choice

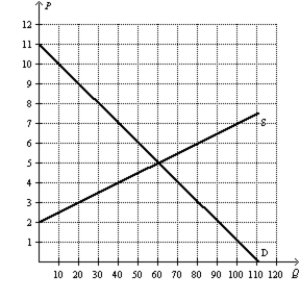

Figure 8-22

-Refer to Figure 8-22.Suppose the government changed the per-unit tax from $3.00 to $4.50.Compared to the original tax rate,this higher tax rate would

A) increase tax revenue and increase the deadweight loss from the tax.

B) increase tax revenue and decrease the deadweight loss from the tax.

C) decrease tax revenue and increase the deadweight loss from the tax.

D) decrease tax revenue and decrease the deadweight loss from the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: A decrease in the size of a

Q24: Suppose that the market for large,64-ounce soft

Q25: The higher a country's tax rates,the more

Q26: Figure 8-20<br>On the vertical axis of each

Q27: The graph that represents the amount of

Q29: Which of the following events is consistent

Q30: With linear demand and supply curves in

Q31: Figure 8-21 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-21

Q32: Which of the following scenarios is consistent

Q33: In which of the following instances would