Short Answer

Scenario 8-3

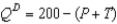

Suppose the market demand and market supply curves are given by the equations:

-Refer to Scenario 8-3. Suppose that a tax of T is placed on buyers so that the demand curve becomes:  What quantity will be bought and sold after the tax is imposed?

What quantity will be bought and sold after the tax is imposed?

Correct Answer:

Verified

The quanti...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Assume that for good X the supply

Q11: Assume the supply curve for cigars is

Q47: Taxes cause deadweight losses because taxes<br>A)reduce the

Q51: Figure 8-26 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-26

Q69: When demand is relatively elastic, the deadweight

Q90: Figure 8-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-1

Q109: To fully understand how taxes affect economic

Q140: Figure 8-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-10

Q165: The most important tax in the U.S.

Q315: Figure 8-2<br>The vertical distance between points A